Explore Term Insurance Benefits in India

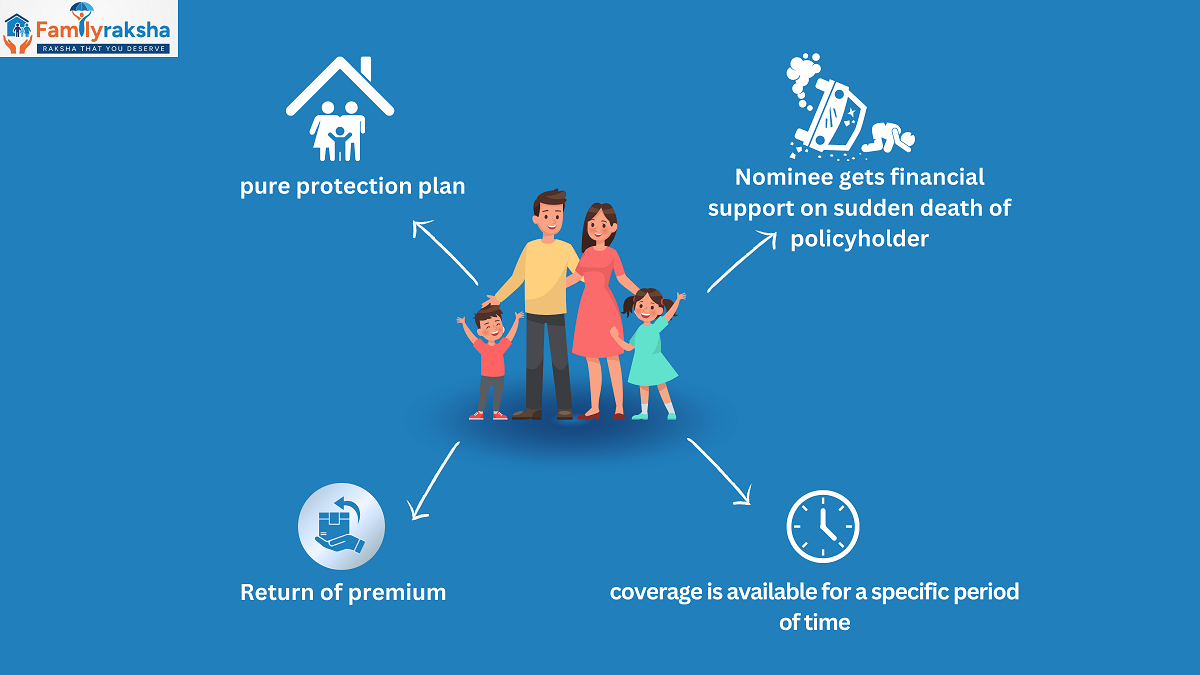

Term Insurance is pure protection plan available and simple form of life insurance policy suitable for your family members. In the unfortunate event, your family could get financial protection for their monthly requirements. Availing the term insurance benefits in income tax is also one of the spectacular options for saving your money.

Normally, the life cover also offers the predetermined sum assured based on the policy in the event of death. It is also quite an efficient option to choose the term policy premiums even with the exchange for life covers. These are completely based on the premium payment mode and are helpful for protecting your family in their absence.

Knowing about the term insurance benefits is the ultimate option for easily making the best future investment in case of your demise. Securing your family is essential so they can reap more benefits. You can choose the insurance plan based on your financial goal accordingly.

What Are The Benefits Of Term Insurance?

- High Sum Assured: The biggest benefit of availing of the Term Insurance Plan is to get the high sum assured at the most affordable premium. It is one of the simplest forms of insurance. These are available at the most affordable costs when compared to the other Life Insurance policy. Whether you are buying term insurance online, then, the premium will be lower when compared to buying them offline. Cost-saving could also happen at the insurer’s end so they can be easily transferred.

- Life Cover: Term Insurance is a pure protection plan that offers extensive coverage for your life. Normally, your family members will be secured with the life cover when you are in the policy term. These will be terminated when the policy term is complete.

- Regular Investment: Premiums paid in the Term Insurance can be easily paid based on the mode of your choice. These also keep the policy completely active even without any hassle. You need to know about the term insurance benefits and drawbacks before buying the policy. Choosing the Term insurance policy is a fantastic option for your investments. These have higher life cover and protect your family from the financial crisis in the event of your demise.

- Income Tax Benefits: Term insurance offers better tax benefits. Normally, the premium you are paying for the Term Insurance policy will be completely Tax deductible. Payouts also come with better tax exemptions based on existing tax laws. It will be a greater option for saving your money with the Tax benefits even without any hassle.

- Tax Benefits Under Section 80C: Income Tax Act 1961 Section 80C allows the premium you pay for buying the Term Insurance is normally exempt even to the minimum of Rs.1.5 Lakh a year. It is convenient to get the tax benefits with the term insurance under Section 80C for purchasing a plan for maximum coverage. These are completely based on health and age.

- Tax Benefits Under Section 10(10D): The death benefit of Term Insurance will be completely exempt based on provisions of Section 10(10D) of the Income Tax Act 1961.

- Easy To Understand Policy:Before buying the term insurance, it is essential to understand all insurance-specific terms. Knowing about ‘what is term insurance benefits’ is essential before opting for the policy. These policies are easier to understand and you can easily opt for this service even without any hassle.

Normally, the term insurance plan is a pure life cover, so this does not involve any investment component. The insurer covers for a fixed duration when you pay the premium.

- Multiple Death Benefit Payout Options: Whether you are paying the EMIs for your car, home, or even the personal loan, then it is essential to choose the premium accordingly. In the event of your demise, the family members could be suffering from financial liabilities.

Payout options with the term insurance policy are helpful for them during this condition. Normally, the defendant could be getting the lump sum of the amount in the event of unfortunate demise. This lump sum amount will be quite helpful for them to easily manage their financial liabilities.

Term Insurance Plan also gives you a better option for receiving the monthly income with a lump sum amount. The term insurance benefits on maturity are higher, and you would get more payouts based on the premium. Your family could be finding it easier to manage regular expenses with the monthly income. - Best Financial Protection:The Term Insurance policy is the perfect option for protecting your beneficiaries in the event of your demise. Your family members or the beneficiaries could get the predetermined sum assured based on the policy. Sum assured are the paid out with the death benefits for the nominee.

- Maturity Benefits: Purchasing Term Insurance offers a better return for the sum of the Premium, which has been paid for the maturity. You would be getting the best maturity benefits so you can simply plan for finances. It is also quite convenient for utilizing the commitments and goals for the future.

- Additional Riders Strengthen Policy: Policyholders can easily opt for the Add-ons or Riders along with the Term insurance plans. These Additional Riders are better option for easily enhancing long term insurance benefits. You can simply opt for them to easily save your money even without any hassle. Adding the riders with the Term Insurance is helpful for paying the nominal additional premium.

For example, when you are buying the Premium of term insurance plus Rider, then it provides a waiver for future premiums. In the event that you are diagnosed with a specified critical illness, then it will be suitable for getting the complete cover.

Life cover with the add-ons will be suitable for getting extra benefits in the event of unexpected things. Term Insurance plans also extensively offer the rider benefits if contingencies such as critical illness, accident, and many others. There are many numbers of riders available with term insurance plans, such as- Accidental Death Benefit Rider: The Accidental Death Benefit Rider is the add-on you can buy along with the Term Insurance. These give benefits to the family members when the policyholder is dead during the accident. An additional sum will be paid to the beneficiary. It will be over the assured sum which has been received along with the death benefit. The assured sum will be paid to the beneficiary in case of a normal death.

- Accidental Disability Rider: The Accidental Disability Rider is also available in many numbers of Term Insurance policies. This policy will be effective only in case the person is disabled due to an accident. Normally, a certain percentage of the Assured sum will be paid as the regular income from the insurer. The beneficial or the nominee will be getting the benefits only for the specific time. If the disability occurred due to the accident, then this rider in the policy will be effective.

- Accelerated Death Benefit: If the Term Insurance policyholder has been suffering from a terminal illness, the money will be needed for medical expenses. This lump sum amount will be paid out even in advance for the medical care.

- Coverage For Critical Illness: Whether you are suffering from critical illnesses, then some treatments could be draining your savings. The primary benefits of the Term Insurance policy offer life covers. You could also easily choose to get critical illness coverage to get more benefits. You can easily choose the Add-ons or riders along with the Term Insurance policy.

Term Insurance offers critical illness riders along with many other plans. When you opt for this policy with the add-on then you can easily pay for necessary treatment even without consuming the savings.

Choosing The Right Term Insurance Plan

In the modern day, there are a variety of Term Insurance plans available. You need to know about the term insurance benefits along with the add-on before buying them. It is essential to know that it is not one-size-fits-all, so it is a completely better option to check the complete process before buying them. It is better to take more life cover based on financial liabilities.

You can simply choose the appropriate add-ons based on the coverage that you seek. You need to keep in mind that they understand different factors before buying term insurance plans. The term insurance policy is available in the online and offline modes.

Calculating the term insurance premium helps you to know more about the term insurance benefits in income tax. Normally, the Premium amount that has been stated will be completely inclusive of the GST. The payable annually will be until 60 years of age.

Conclusion:

Term insurance plans are a better option for investments as they give you tax exemptions Under Sec 80C and 10(10D) on the Income Tax Act. It makes the term insurance plans the best steady investment. These are very beneficial for attaining the maximum benefits. Understand various facets that are related to buying term insurance plans. Some of them include the Sum Assured, Debt Repayment, and more